Income Tax Chart 2018

Withholding from employees wages.

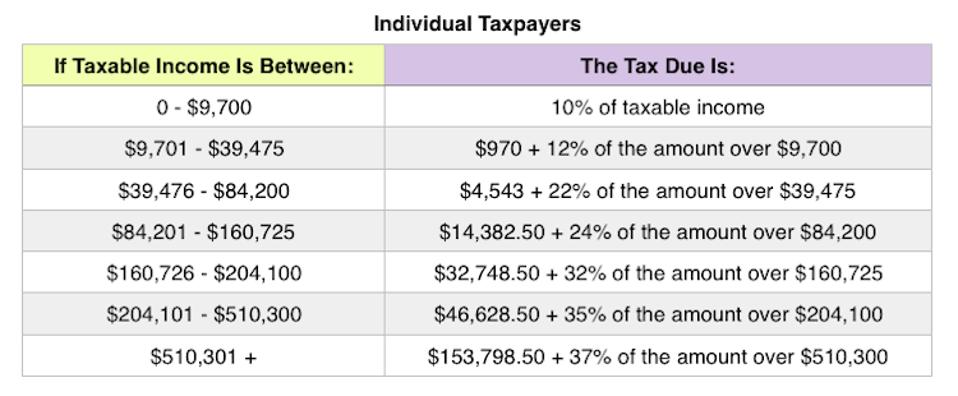

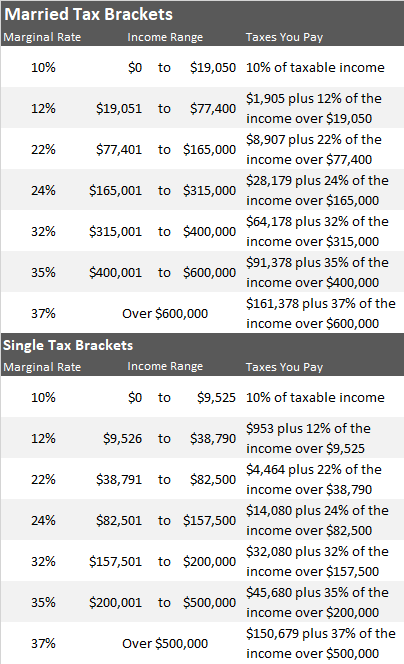

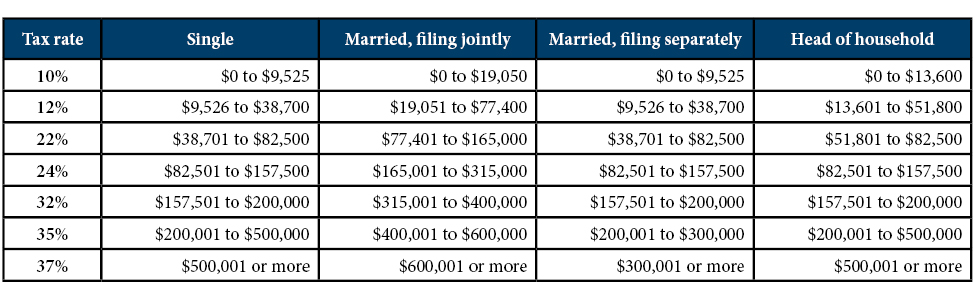

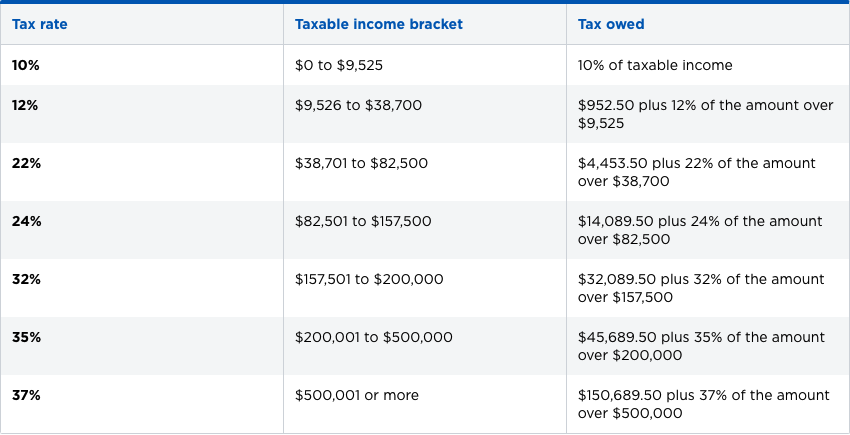

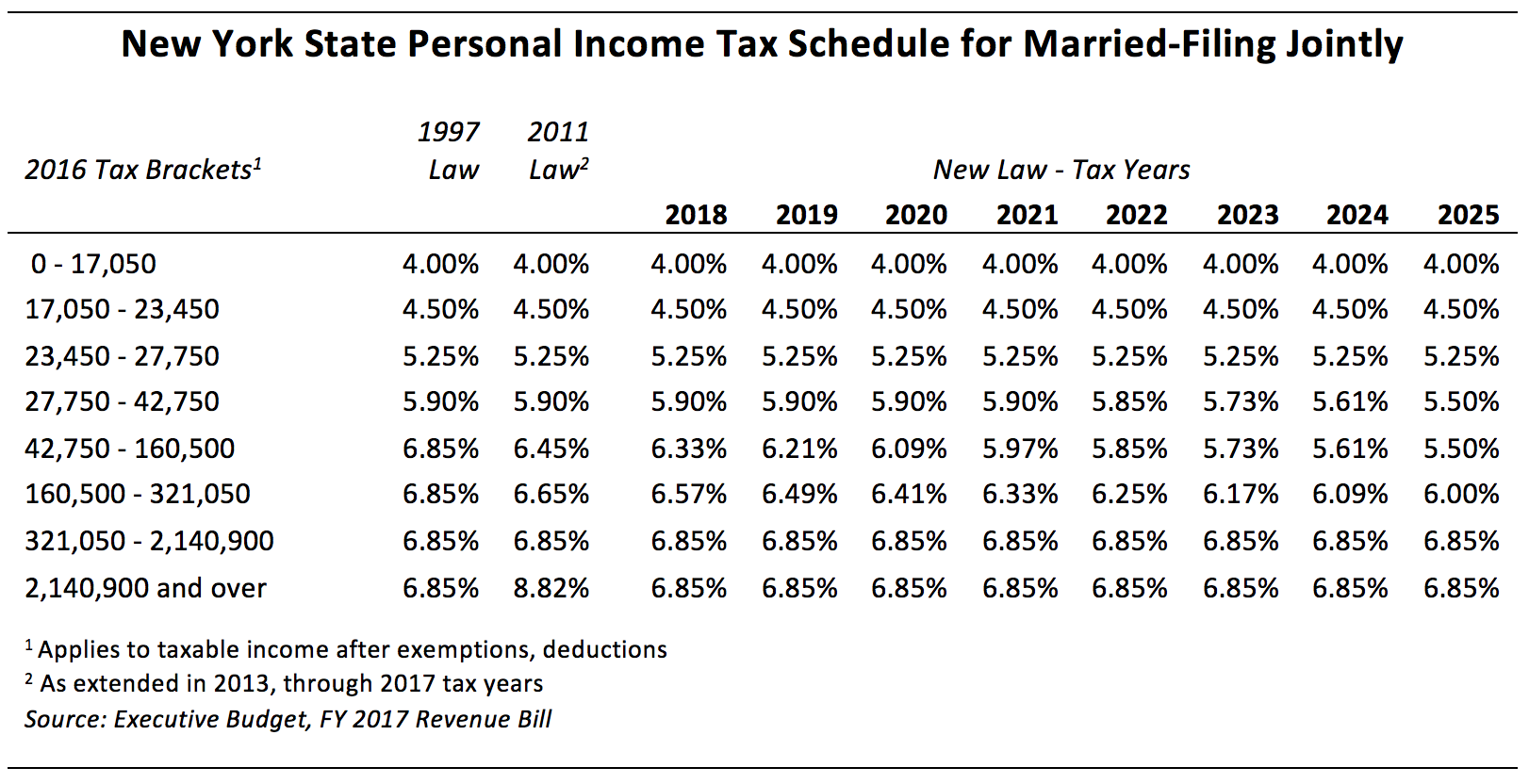

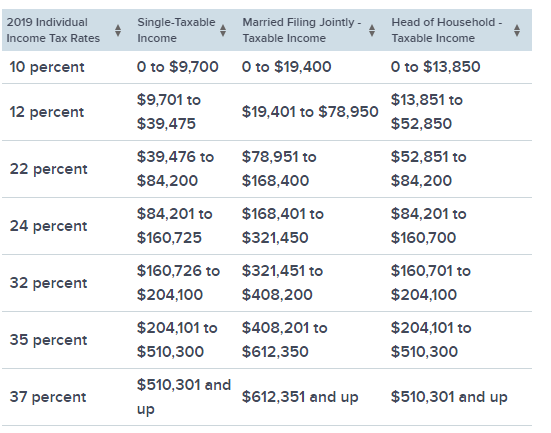

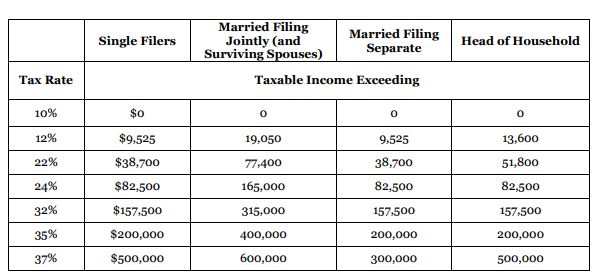

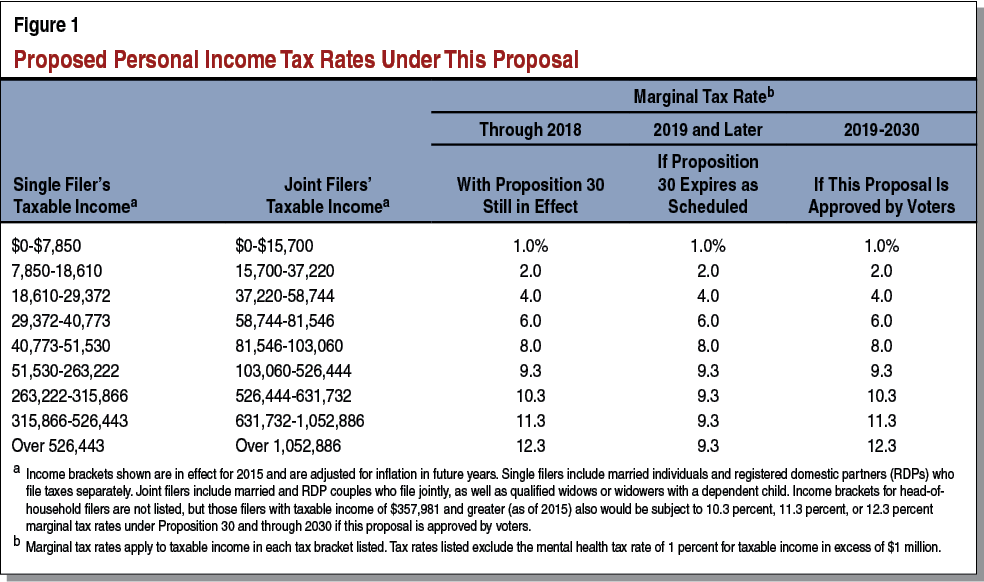

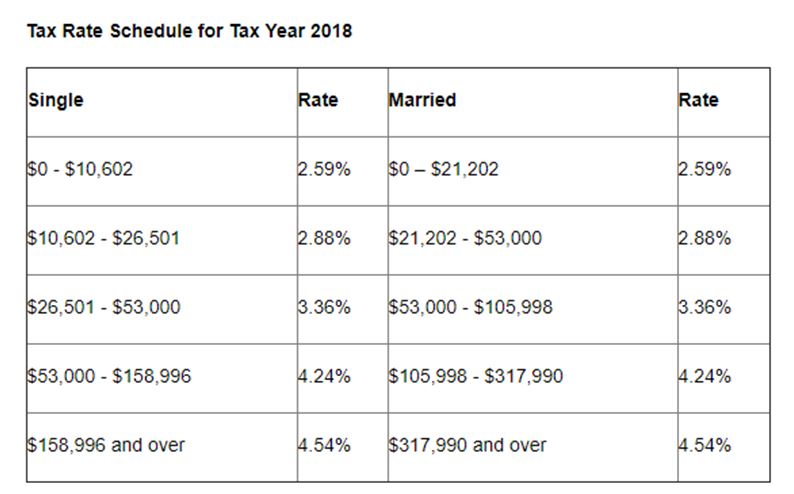

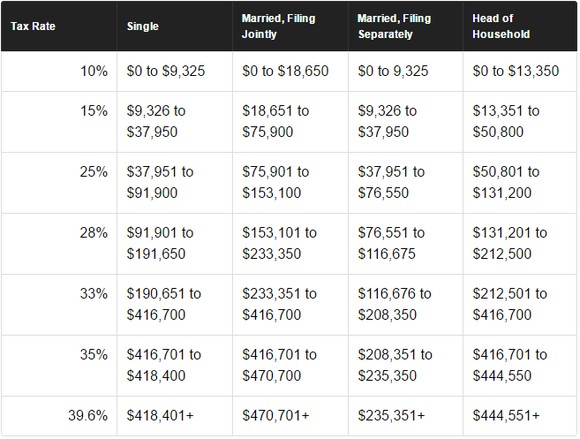

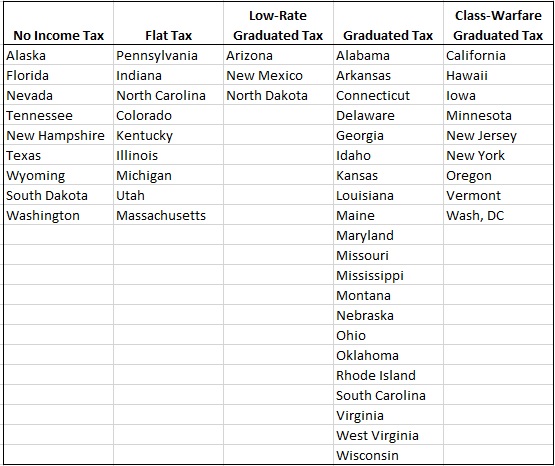

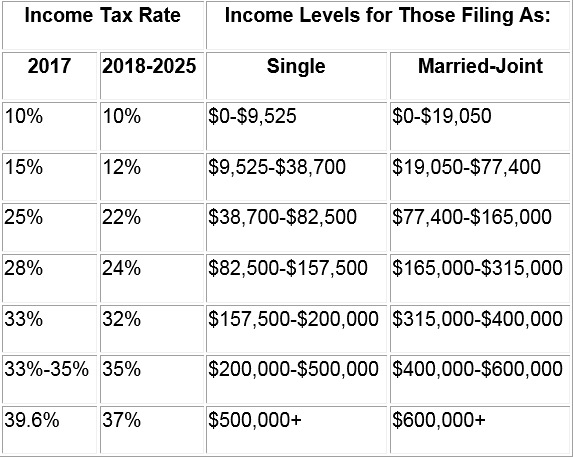

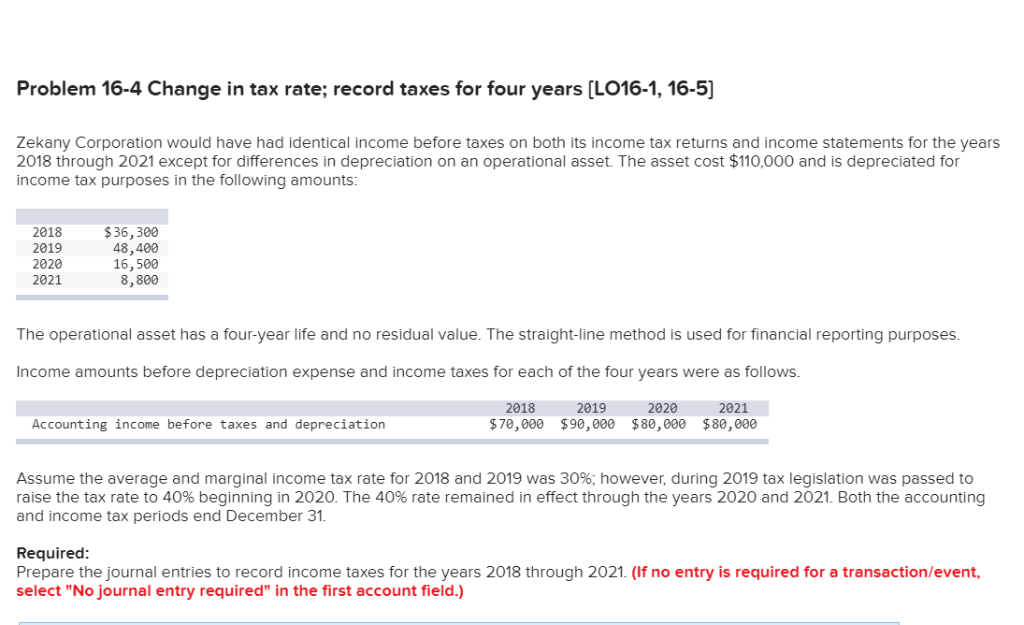

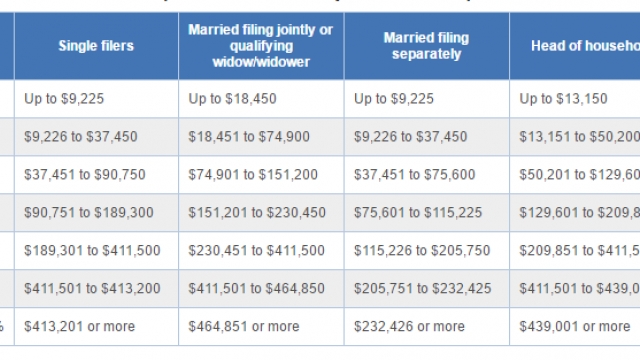

Income tax chart 2018. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2. A separate tax must be computed for you and your spouse. Tax table and tax rate schedules.

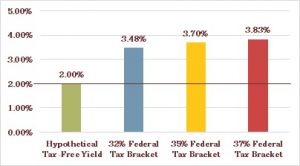

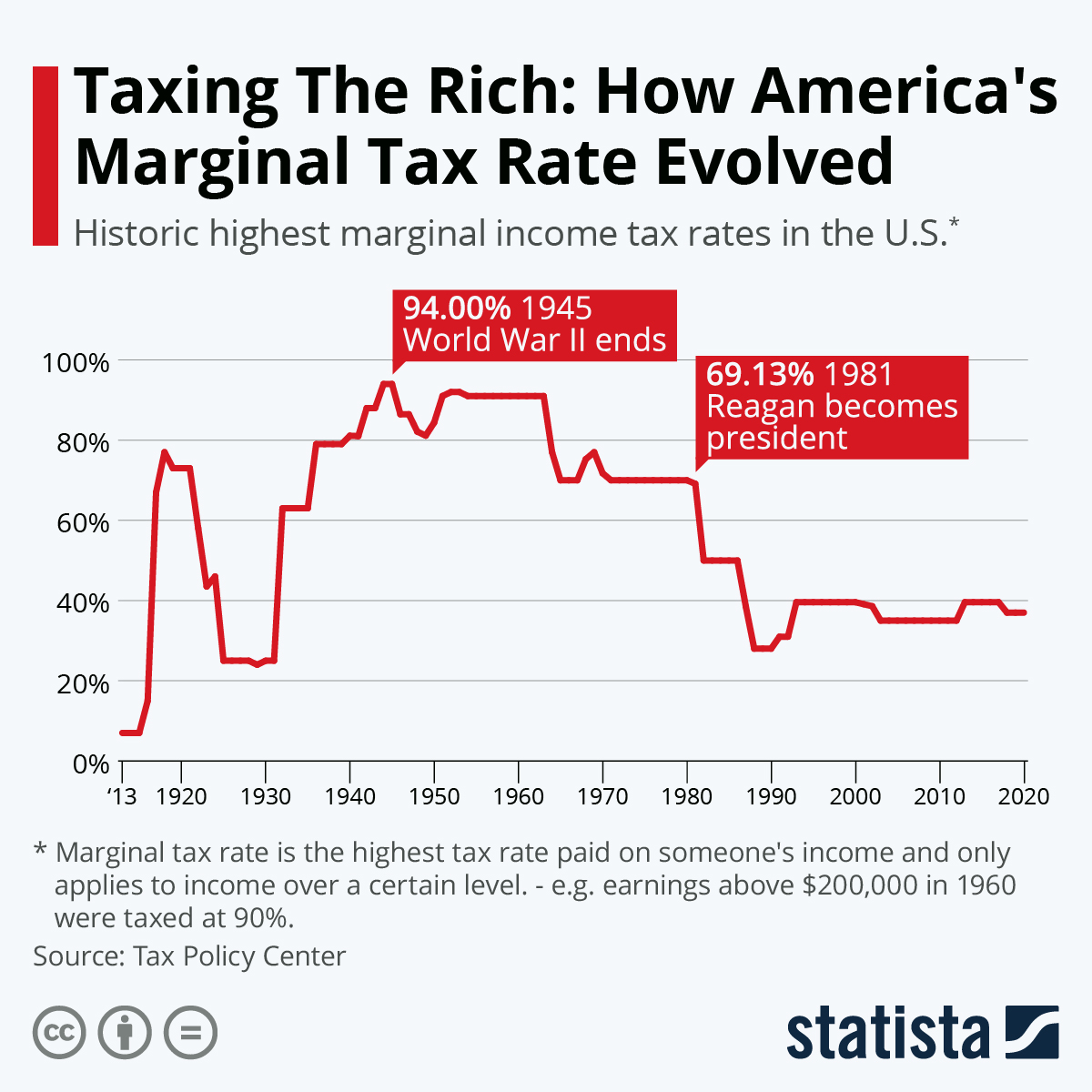

You may also be interested in using our free online 2018 tax calculator which automatically calculates your federal and state tax return for 2018 using the 2018 tax tables 2018 federal income tax rates and 2018 state tax tables. Income tax calculator estimate your 2019 tax refund. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly.

How to calculate federal tax based on your annual income. Brown are filing a joint return. Instructions for form 1040 u s.

Prior year tax tables. Washington the internal revenue service today released notice 1036 which updates the income tax withholding tables for 2018 reflecting changes made by the tax reform legislation enacted last month this is the first in a series of steps that irs will take to help improve the accuracy of withholding following major changes made by the new tax law. Icalculator aims to make calculating your federal and state taxes and medicare as simple as possible.

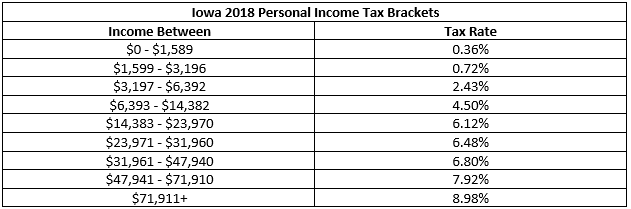

Optional sales tax tables. Answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much you ll get as a refund or owe the irs when you file in 2020. Below are the tax tables which are integrated into the united states tax and salary calculators on icalculator.

2018 tax table see the instructions for line 11a to see if you must use the tax table below to figure your tax. Individual income tax return. First they find the 25 300 25 350 taxable income line.

Their taxable income on form 1040 line 10 is 25 300. If the missouri taxable income is. 0 to 102.

To identify your tax use your missouri taxable income from form mo 1040 line 23y and 23s and the tax chart in section a below.